Getting Started with Medicare

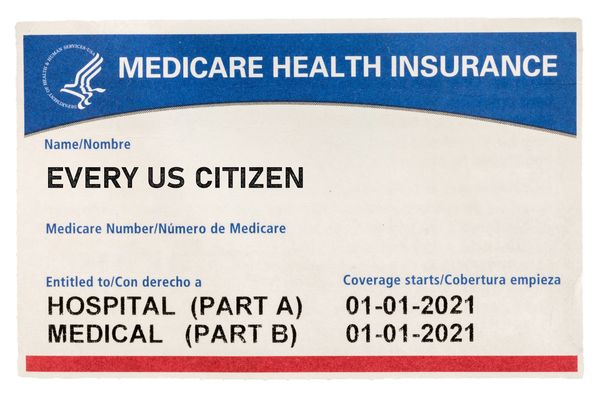

Medicare is health insurance for people 65 or older. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig’s disease).

Some people get Medicare automatically, others have to actively sign up -- it depends if you start getting retirement or disability benefits from Social Security before you turn 65.

Also, you don't have to take Medicare at 65 if you are still working and have "creditable coverage" through your employer. It's important to analyze the cost and benefits of staying with your employer coverage vs signing up for Medicare.

This information comes from www.medicare.gov.

Part A (Hospital Insurance) helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care.

Part B (Medical Insurance) helps cover:

- Services from doctors and other health care providers

- Outpatient and some home health care

- Durable Medical Equipment (like wheelchairs, walkers, etc.)

- Many preventative visits (yearly "Wellness" visit, screenings, shots/vaccines)

Part D (Drug Coverage) helps cover the cost of prescription drugs. You get this coverage either through a stand-alone prescription drug plan, or by joining a Medicare Advantage Plan.

The "Gaps" of Coverage

Parts A & B (Original Medicare) leave gaps. Most people choose to address those gaps in 1 of 2 ways...

- Adding a Medicare Supplement (Medigap) Policy and a Prescription Drug Plan (PDP).

- Enrolling in a Medicare Advantage Plan (with or without prescription drug coverage).

One way to cover the "gaps"

Medicare Supplement (Medigap)

- Medigap plans, offered by private insurers, help cover costs like deductibles, copays, and coinsurance that Original Medicare doesn’t pay. These plans have a monthly premium and let you see any doctor who accepts Medicare nationwide. They do not include prescription drug coverage, so a separate Part D plan is (often) needed.

Medicare Part D (Prescription Drug Plans)

- Medicare Part D plans, offered by private insurers, help cover the cost of prescription drugs. Each plan has a formulary (list of covered drugs) and may have monthly premiums, deductibles, and copays. Costs and covered medications vary by plan and location.

Another way to cover the "gaps"

Medicare Advantage (Part C):

- Offered by private insurers approved by Medicare. They work similarly to job-based health insurance.

- Combine Part A (hospital) and Part B (medical) coverage, often with little to no premium, and you pay copays or coinsurance as you use services. Many plans also include extras like prescription drugs, dental, vision, and hearing. Availability and costs vary by location.

Extra Credit:

Here's an additional video (32 minutes) that gives a deeper dive into the differences between Medicare Advantage and Medicare Supplement (Medigap).

I'm here to help!

If you made it this far, good for you! I would love to help guide you through your Medicare decisions or review your current coverage.

Licensed in Nebraska, Iowa, and Arkansas. May not offer every plan available in your area. Any information provided is limited to the plans I do offer in your area. Not affiliated with or endorsed by the United States government or the federal Medicare program. For information on all of your options, contact 1-800-MEDICARE, consult www.medicare.gov or your local State Health Insurance Program (SHIP).

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.